Restaurant Sales tax By State

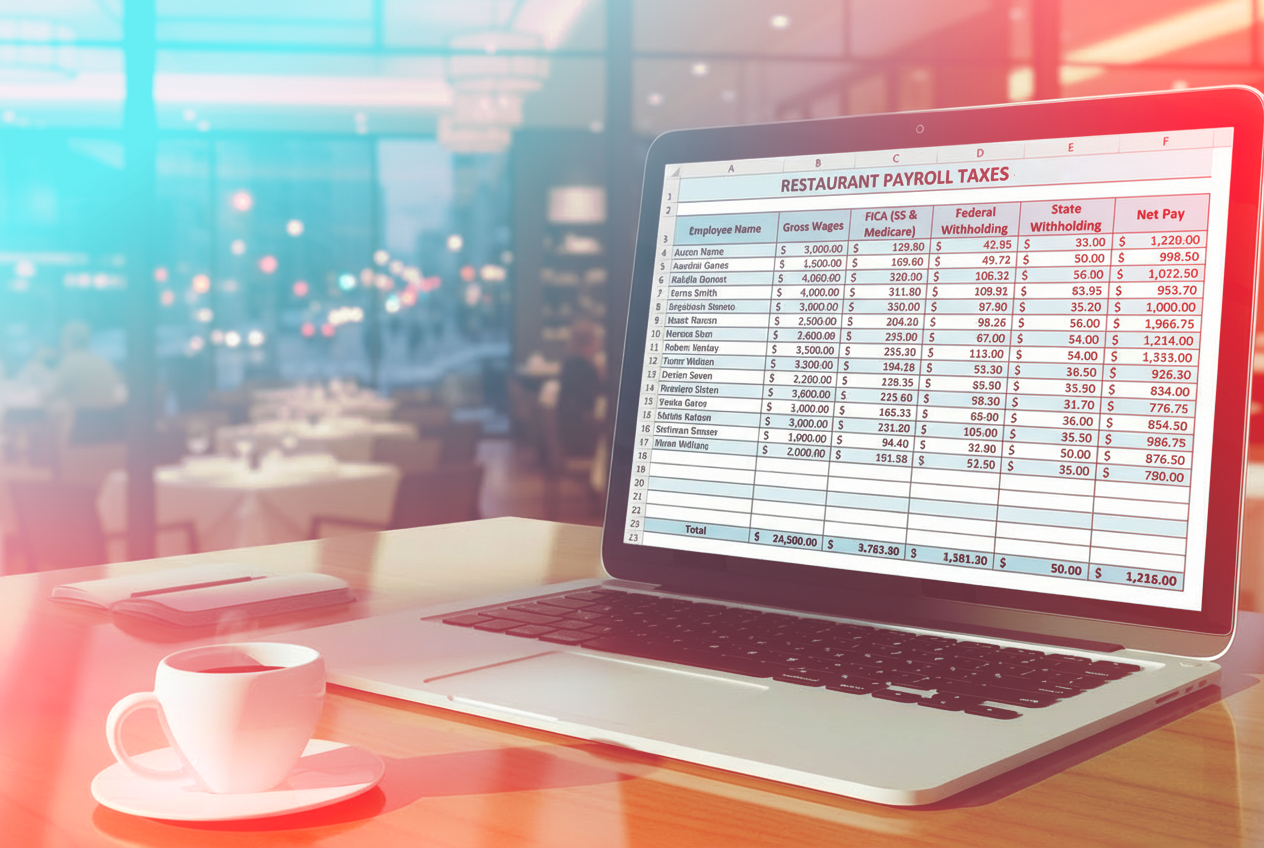

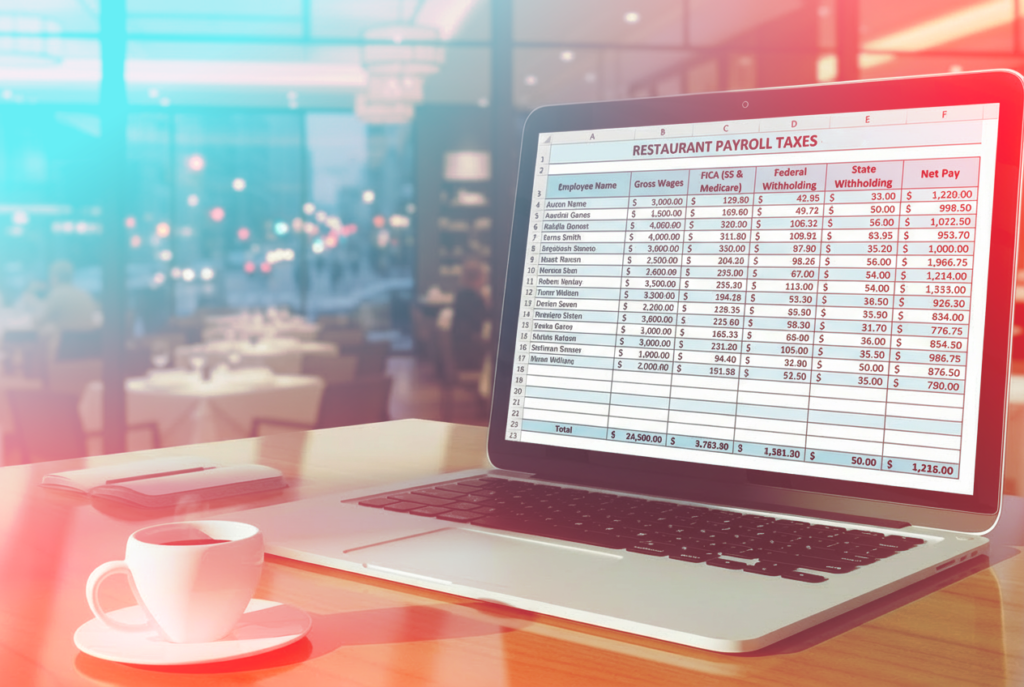

Avoid Costly Back Taxes

Accurate restaurant tax services covering your restaurant payroll taxes too—backed by industry experts. Eliminate stress during tax season.

Comprehensive restaurant tax services- Integrated with Your Books

We handle your restaurant’s taxes from start to finish—federal and state income tax filings, 1099 preparation for contractors and staff, and franchise and business tax filings, including multi-state restaurant locations.

Tax classification

Work with a dedicated tax professional who has deep experience in restaurant taxation.

Proactive tax planning

Because your restaurant accounting is already accurate, your tax filings are too—no last-minute scrambling during busy service hours.

What success looks like with our business tax experts:

Your tax expert and accounting team work seamlessly behind the scenes to complete every filing on time. You’ll have access to:

- Clear timelines and live filing status

- Secure document sharing

- Proactive communication throughout tax season

Accurate filings. Clear communication. No surprises.

Ready to simplify tax season with Rescountant?

You’ll work with a dedicated tax professional who has deep experience in restaurant taxation. Have a question? You’ll get clear, timely answers from someone who understands your restaurant financials—not a generic support queue CTA

Sync your favorite finance tools, seamlessly

We have deep expertise in the tools you use, and leverage integrations to ensure that your monthly bookkeeping process is effortless.

Let's start growing!

Improve how you manage your finances with our easy-to-use accounting services. We handle bookkeeping and tax preparation for you, so you can focus on growing your restaurant without worrying about the paperwork and other administrative tasks.

Or provide us with your details, and our team will reach out to you.

Get in touch

Contact our restaurant accounting experts and tell us how we can assist with your financial needs.